The 2025 WIPO Pathfinders Report describes trends, priorities, and scenarios that intersect with the solutions, models & mechanisms underlying IP Bonds & IP CDOs. Let's dive in the report conclusions.

Economic Forces and Intangible Asset Valuation

-

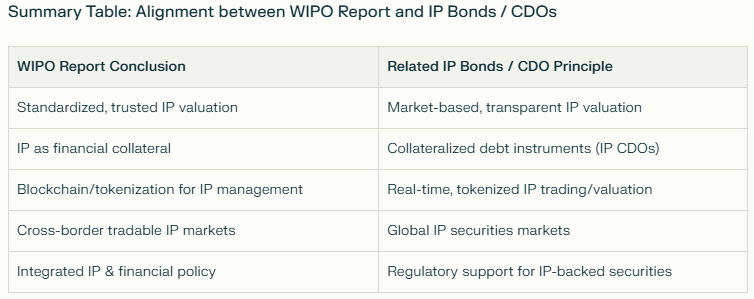

The report highlights the growing value of intangible assets and the critical need for a global IP marketplace with standardized valuation methods. Participants agreed that a transparent, trusted, and accessible system for valuating IP is necessary to unlock its economic potential for businesses (especially SMEs) and enable new forms of financial investment.

-

There is strong emphasis on creating standardized, market-driven methodologies to commercialize IP assets, positioning them as credible gateways to financing and as tradable economic assets—core principles behind IP Bonds and CDO models.

Financial Instruments and IP as Collateral

-

The report states that in 2034, in a preferred scenario, “financial institutions readily accept IP assets as collateral, as a result of established valuation methodologies that have brought trust and investment to the sector. IP certificates have become a valuable financial instrument, opening new funding avenues for innovators and creators.”

-

This directly aligns with the function of IP Bonds/IP CDOs, which transform IP rights into tradable, collateral-backed debt securities to unlock liquidity and enable new financing models for innovation.

Digital Transformation and Blockchain

-

The report identifies digital transformation, blockchain, and tokenization as immediate priorities for the future IP system. Implementation of technological solutions such as blockchain and NFTs to manage, register, and protect IP is recognized as a way to streamline processes and facilitate cross-border IP management.

-

The use of blockchain to create tokenized, real-time valuation mechanisms for IP— the very infrastructure proposed for IP Bonds—falls within the priorities outlined for modernizing the IP ecosystem.

Integration with Global Financial Markets

-

The scenarios explored foresee the development of cross-border, standardized systems that allow trading and collateralization of IP as a financial asset. The report’s broader future vision is for IP to function as both a tradable and financeable asset class, connecting innovation directly to global markets, consistent with the 100% role of IP Bonds.

IP Policy Recommendations

-

Participants in the report call for the integration of IP policies into national economic strategies, including collaboration with financial regulators and development of new methods to use IP assets to catalyze economic growth through flexible financing and market-based valuation—providing IP policy cover for innovations like IP CDOs.

In summary:

The 2025 WIPO Pathfinders Report actively advocates for IP Bonds & IP CDOs underlying principles: market-based IP valuation, use of IP as financial collateral, development of IP-backed securities and financial instruments, blockchain-driven digital transformation, and integration of intangible asset finance with the broader economic system.

The 2025 WIPO Pathfinders Report is the groundwork for the emergence and adoption of IP Bonds & IP CDO models worldwide.